cardinal health enterprise value

The PEarnings NTM ratio of Cardinal Health Inc. 5196B for May 4 2022.

Cardinal Health Cah Hits 52 Week High What S Aiding It

Is a healthcare services and products company which engages in the provision of customized solutions for hospitals healthcare.

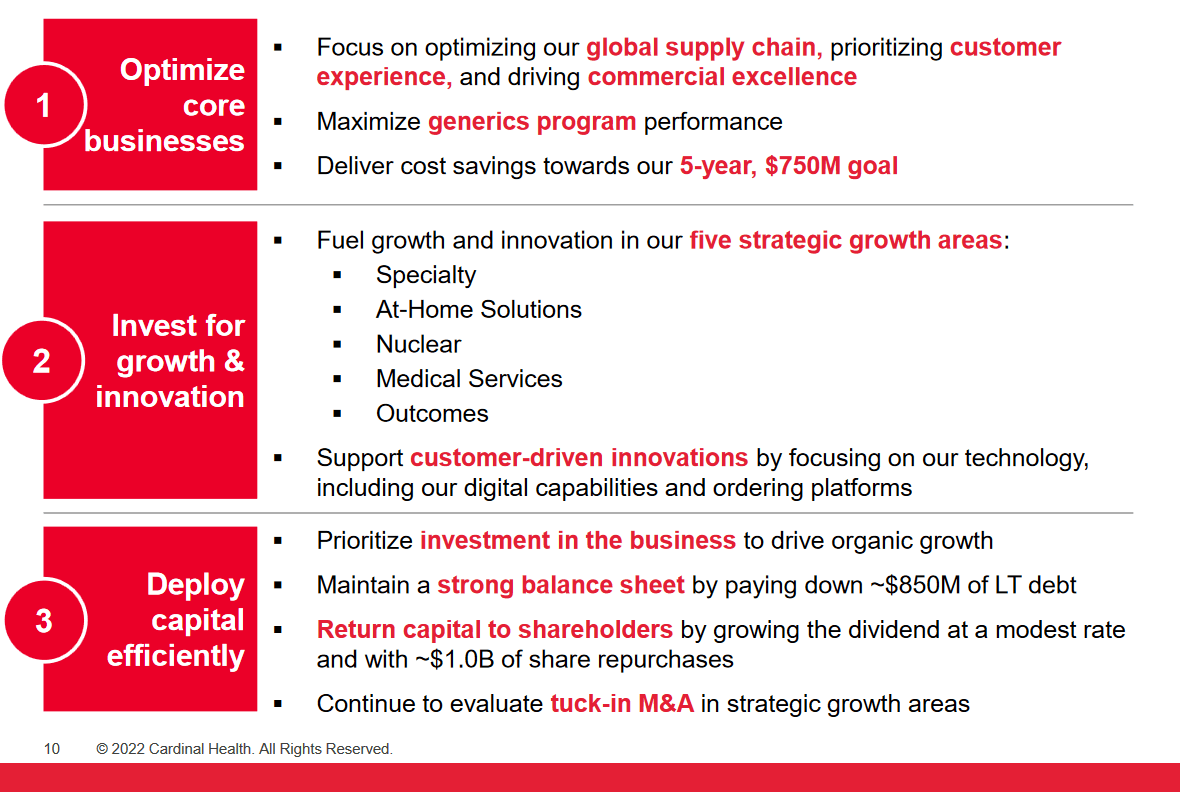

. 1925B Henry Schein Inc. We aspire to be healthcares most trusted partner by building upon our scale and heritage in distribution products and solutions while driving growth in evolving areas of healthcare through customer insights data and analytics and focusing our resources on what matters most. DUBLIN Ohio Aug.

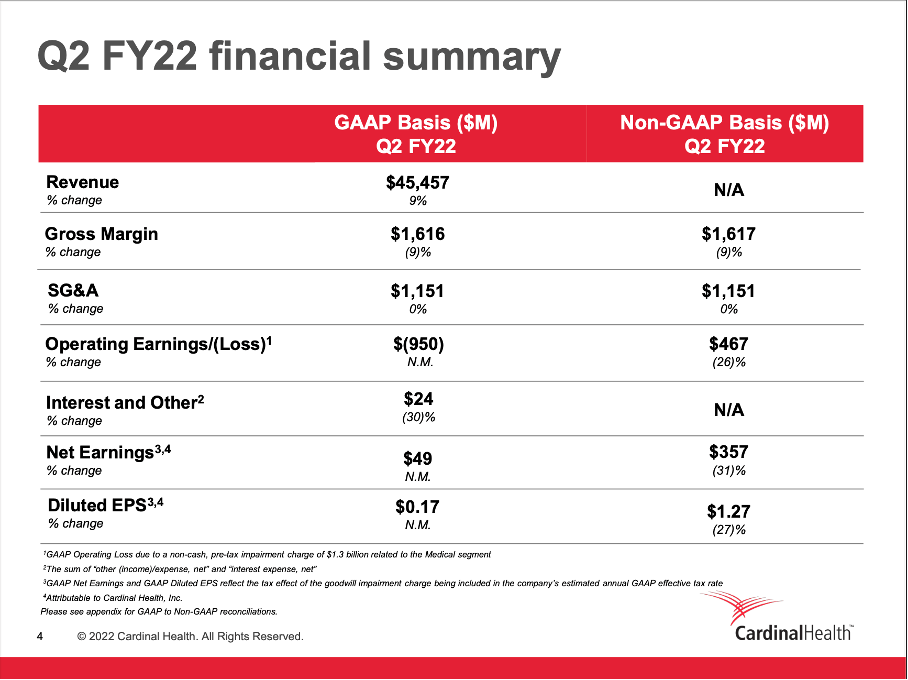

The Enterprise Architecture team is a highly engaged team focused on business data and technology architecture that is passionate about enabling Cardinal Healths mission. CAH today reported second quarter fiscal year 2022 revenues of 455 billion an increase of 9 from the second quarter of last year. The company valuation of Cardinal Health Inc.

Enterprise Value to Sales 011. 26 rows Cardinal Health Enterprise Value. Cardinal Healths EBIT for the trailing twelve months TTM ended in Dec.

Medical Supply Distribution Solutions. Global Procurement is responsible for creating and managing diverse strategic supplier partnerships that drive enterprise value with innovation best cost and competitive advantages that benefit customers suppliers and patients. 1839B for April 6 2022.

Historical Enterprise Value Data. Therefore Cardinal Healths EV-to-EBIT ratio for today is 15513. CAH including valuation measures fiscal year financial statistics trading record share statistics and more.

Zacks Investment Research is releasing its prediction for CAH based on the 1-3 month trading system that nearly triples the SP 500. View 4000 Financial Data Types. All rights reserved Legal Terms of Use.

5 2021 PRNewswire -- Cardinal Health NYSE. Forcasts revenue earnings analysts expectations ratios for CARDINAL HEALTH INC. If you are passionate about data including integration and analytics then this role may be.

Latest Cardinal Health Inc CAH Stock News. Is slightly higher than its historical 5-year average. View and export this data back to 1994.

The PEarnings NTM ratio of Cardinal Health Inc. Is significantly lower than the average of its sector Drug Retailers. Click here - the.

2021 was 121 Mil. 2022 Cardinal Health Inc. All values updated annually at fiscal year end.

Cardinal Health Inc key financial stats and ratios CAH price-to-sales ratio is 010. 2021 was 121 Mil. Cardinal Health is seeing encouraging top-line growth with 13 YoY revenue growth in Q122 ended September 2021 to 440 billion.

Fiscal year 2021 revenues were 1625 billion a 6 increase from fiscal year 2020. CAH 6124 -033-033 Will CAH be a Portfolio Killer in April. As of today Cardinal Healths Enterprise Value is 18441 Mil.

According to these metrics is way below the market valuation of its sector. This statistic displays the total enterprise value of leading medical surgical or dental supply companies in the United States as of April 30. 1839B for April 6 2022.

The current Enterprise Value is estimated to increase to about 247 B while Free Cash. Second quarter GAAP operating loss was 950 million due to a non-cash pre-tax goodwill impairment of 13 billion related to the Medical segment. As of today Cardinal Healths Enterprise Value is 18770 Mil.

May 04 2022. Enterprise Value to EBITDA 728. CAH today reported that fourth-quarter fiscal 2021 revenue increased 16 to 426 billion.

Stock CAH US14149Y1082. 3 2022 PRNewswire -- Cardinal Health NYSE. Cardinal Healths EBIT for the trailing twelve months TTM ended in Dec.

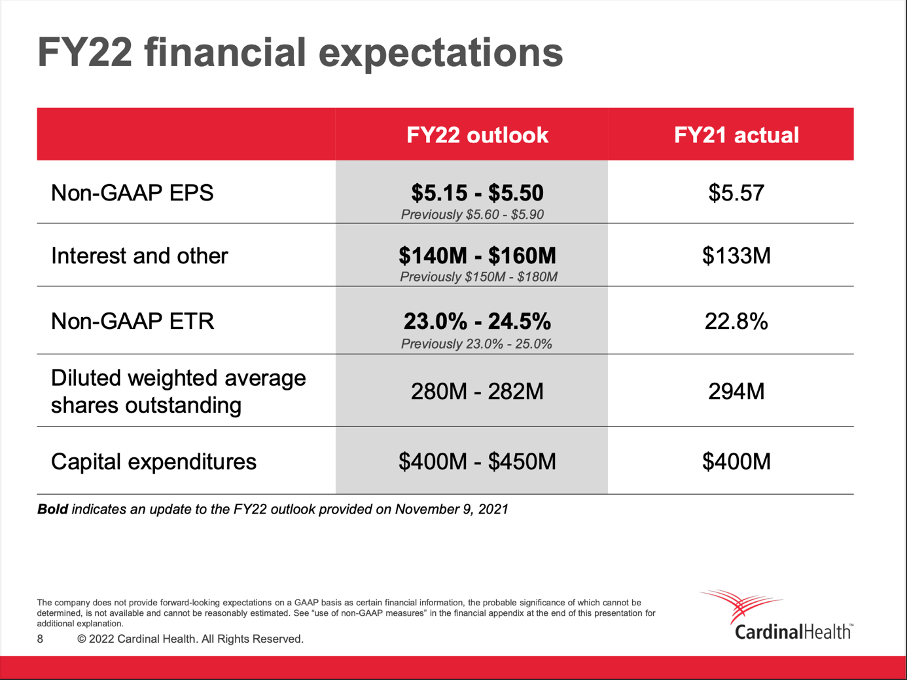

As of 2021 they employed 4730k people. Cardinal Health projected making capital expenditures in this fiscal year of between 400 million and 450 million. The company has an Enterprise Value to EBITDA ratio of 781.

In fact the 167B TTM sales that CAH generated is yet. Supply chain management for healthcare organizations has been catapulted into a role of even greater importance. The Enterprise value factors in Market capitalization cash debt and other assets and liabilities.

Find out all the key statistics for Cardinal Health Inc. Earnings Per Share 208. From our Distribution Essentials to our integrated enterprise capabilities learn how Cardinal Health Medical Distribution Solutions can elevate your supply chain and clinical performance.

As of April 29 2022 Cardinal Health Inc had a 166 billion market capitalization compared to the Retailers - Drug median of 400 million Cardinal Health Incs stock is up 127 in 2022 down 57 in the previous five trading days and down 38 in the past year. It uses Cardinal Healths balance sheet items such as long-term debt the book value of the preferred stock minority interest and other important financials. Which include finished goods commercialized under a vendor brand or the Cardinal Health brand andor as.

Therefore Cardinal Healths EV-to-EBIT ratio for today is 15240. Cardinal Health Enterprise Value. These investments will be primarily for information technology and infrastructure.

This increase includes the favorable prior year comparison from reduced pharmaceutical demand related to COVID-19. DUBLIN Ohio Feb. Per Share Data Cardinal Health Inc.

Talvis Love Stated We All Needed Healthcare To Be Strong So The Work That Our Organization Cardina Leadership Traits Leadership Business Continuity Planning

Cardinal Health Stable And On The Road To Recovery Nyse Cah Seeking Alpha

Pin On 55 Must See Ncpa Annual Convention 2018 Exhibits Booths Boston Ma

Supply Chain Management Courses Eligibility And Top Recruiters Chain Management Supply Chain Management Supply Chain

What Is Employee Engagement Employee Engagement Engagement Communications Strategy

Pin On 55 Must See Ncpa Annual Convention 2018 Exhibits Booths Boston Ma

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

Pin On 55 Must See Ncpa Annual Convention 2018 Exhibits Booths Boston Ma

Pin On 55 Must See Ncpa Annual Convention 2018 Exhibits Booths Boston Ma

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

Top Healthcare Trends Infographic Himss Healthcare Technology Health Care Healthcare Infographics

Pin By Mike Scheer On Financial Tips In 2020 Dividend Investing Finance Investing Investing Money

Hospital And Health System Solutions Cardinal Health

Continuous Improvement Is Good But Is It Lean Lean Six Sigma Change Management Improve